First-time property sellers and buyers are often surprised by the hidden fees that crop up during the property transfer process. One of the most commonly overlooked fees is transfer duty fees and rates and levies advances. Let’s take a look at what these fees are:

Transfer Duty Fee

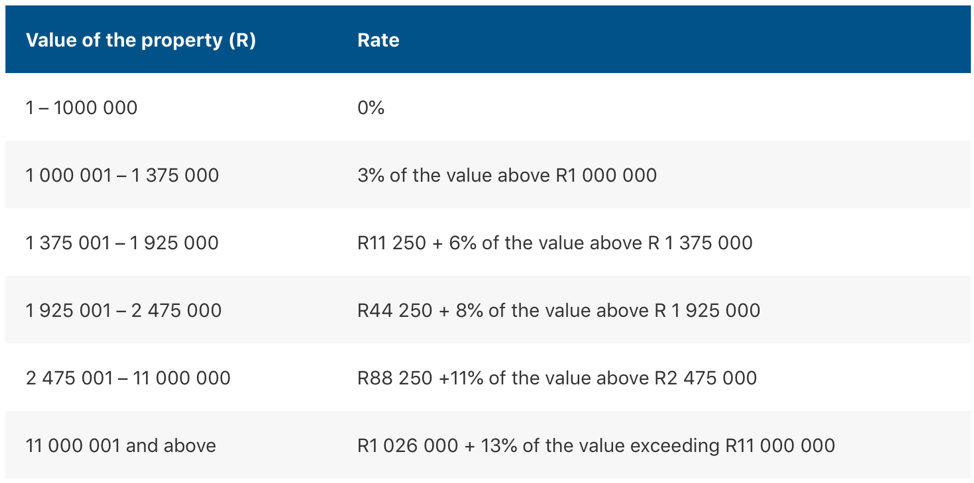

The transfer duty fee refers to a government tax a purchaser is liable for when buying an existing property in order for the deeds office to transfer the property into the purchasers name.

Properties under R1 000 000 attract no transfer duty. See the following table from SARS for calculations:

Conveyancing Fee

In order to lodge your property purchase at the Deeds Office, you will need to hire a conveyancing attorney. Conveyancers have set fees they charge for their services. Keep in mind they do manage the process from start to finish. For an idea on costs, you can refer to the guidelines laid out by the Law Society of South Africa.

Levy Advance

If you are moving into an estate or complex, you will likely need to pay for a set amount of levies in advance. This is referred to as your levy stabilisation fee and can range from R10 000 up to R100 000+ depending on the estate and area.

Rates Advance

The municipality requires you to pay up to 3 months in rates and taxes in advance. Bank on around R7 500 upfront but keep in mind you’ll have a 2 to 3 month break from paying as you move in because you’ve paid in advance.

The reality is that not everyone has extra money lying around, especially when property is involved. Don’t feel overwhelmed by the hidden costs associated with buying a property. Apply for a property bridging loan and get the cash to pay for rates advances, levy advances and transfer duty fees without having to wait for the property sale to go through.